Your AI-Driven Partner for Financial Success.

Empower your personal finance journey with AI-driven insights and tools designed for success.

The Future of Finance is Bespoke

Take control of your financial well-being. Explore our AI-powered solution for your unique financial goals where innovation meets personalization.

Aspayr Proprietary AI

Our AI model personalizes the user experience, offering smart and actionable financial recommendations based on user behavior, goals, and industry best practices.

Engaging Onboarding Assessment

Kickstart your financial journey on Aspayr by answering dynamic quizzes, which serves as a starting point, helping users identify areas for improvement in their financial literacy.

Secure Financial Data Integration

Users have the option to integrate their bank accounts securely with Aspayr, allowing the app to access transaction history and analyze spending patterns.

Our Offerings

At Aspayr we cater to both B2C and B2B audiences providing a unique set of tools for each category to help them make better financial decisions.

🌎 Global Statistics

Did you know?

0 %

of young adults are considered to be financially literate.

0 %

of millennials qualify as financially literate in the United States of America.

0 %

of college educated millennials carry at least one outstanding long-term debt.

0 %

of employees under 40 want their employers to provide financial wellness programs .

Aspayr for Individuals

Some Unique Benefits of using Aspayr.

What's in it for you

Take control of your financial wellbeing. Explore our AI-powered solution for your unique financial goals where innovation meets personalization.

Tailored Insights

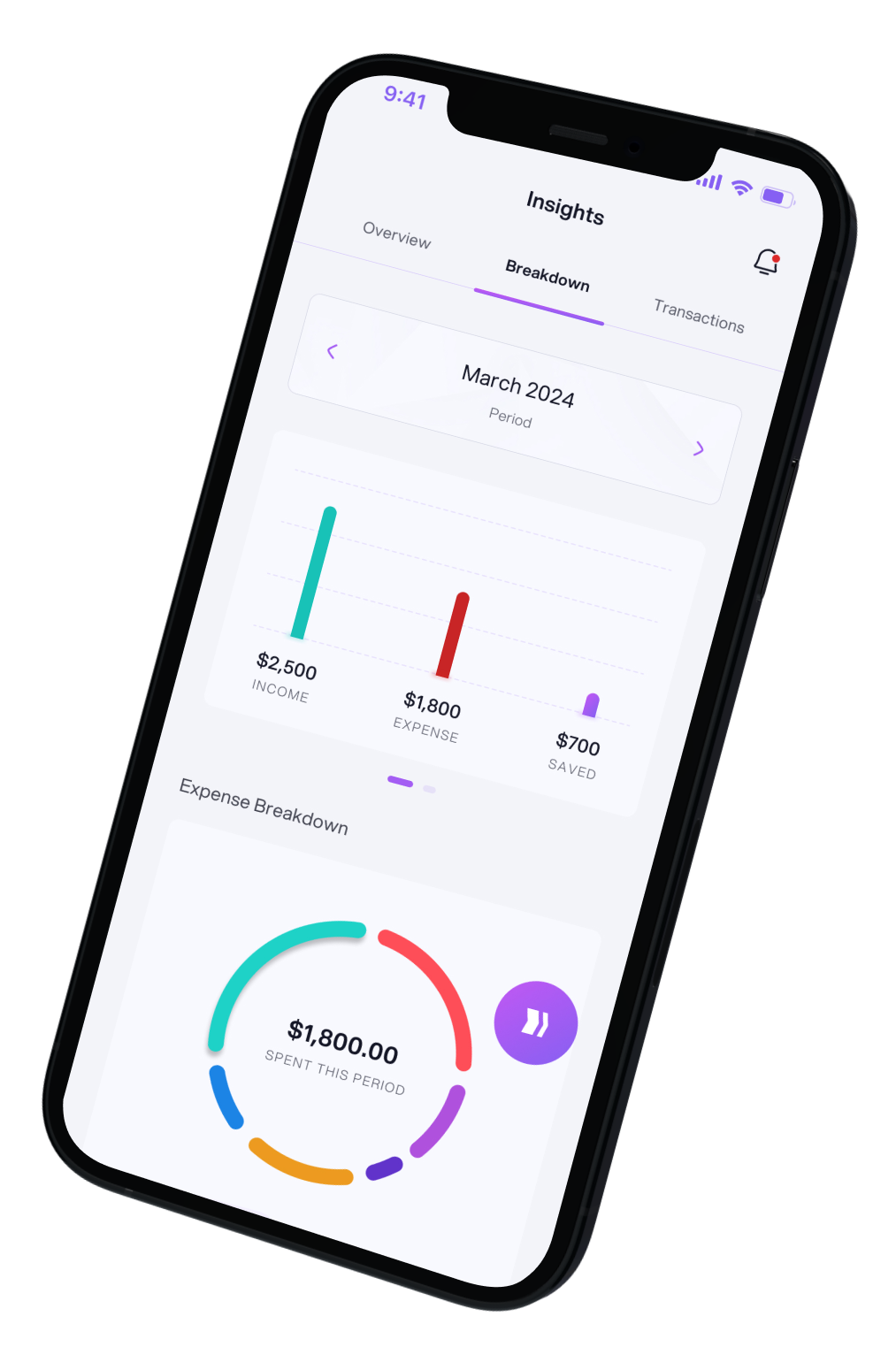

We delve into your financial footprint, deciphering your unique patterns, and crafting insights that match your personal financial exploits.

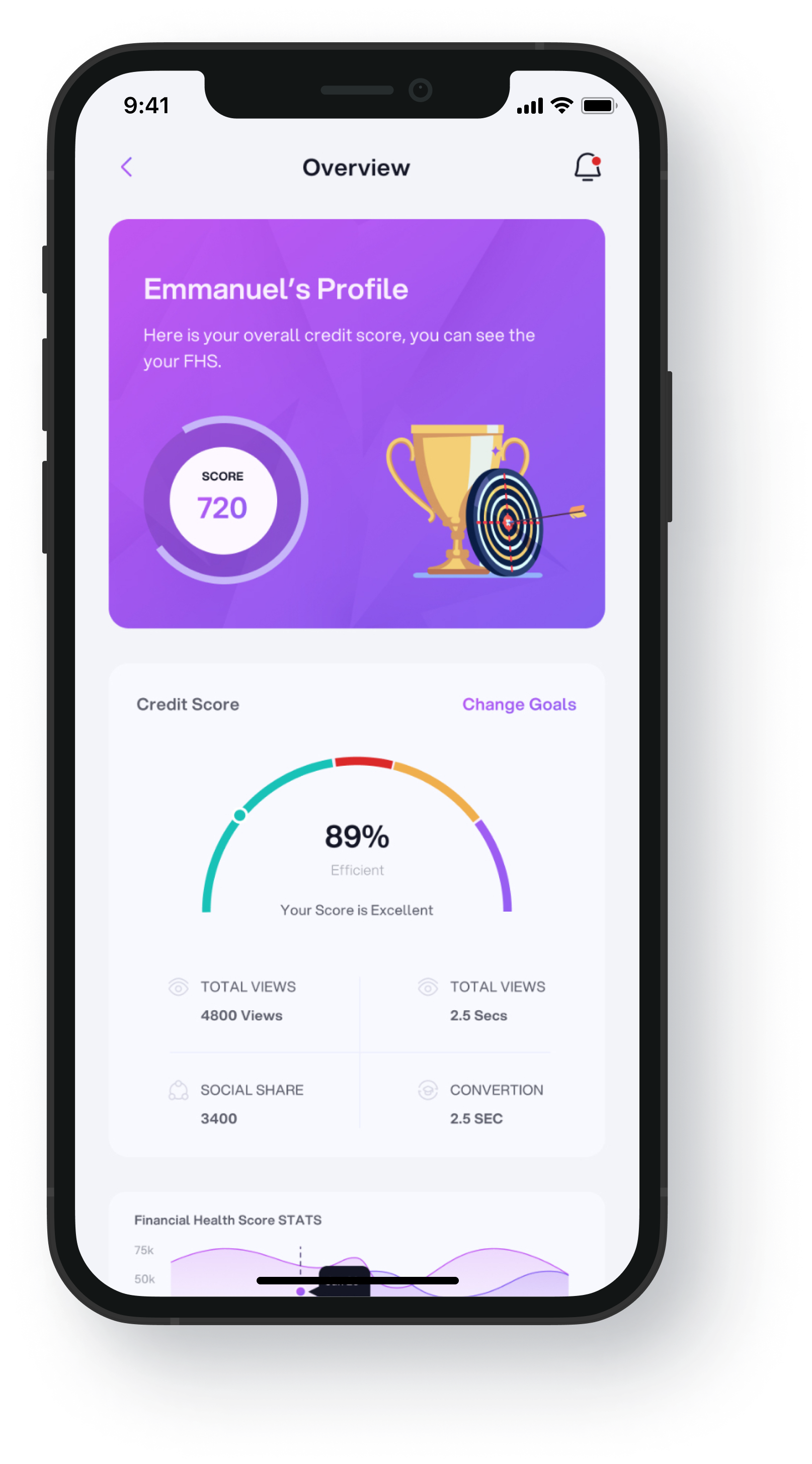

Personalized Dashboard

Guide you in crafting a financial portfolio that’s as individual as your fingerprint. From investment options to creating budget plans.

Streamlined Lessons

An evolving curriculum that adapts to your pace, ensuring your learning experience is as unique as your financial goals.

Discover more with Aspayr Hub

Step into Aspayr, a world with endless possibilities. Take your finances to the next level with our bespoke offerings

Aspayr Learn

We curate video lessons tailored to your financial journey, empowering you with knowledge that truly matters.

Aspayr Perks

We direct you to the best cashbacks, discounts, and rewards, all based on the stores and shops you adore.

Aspayr Finance

Seize the power to make every financial decision count. Perform everyday transactions, invest wisely, and save with confidence.

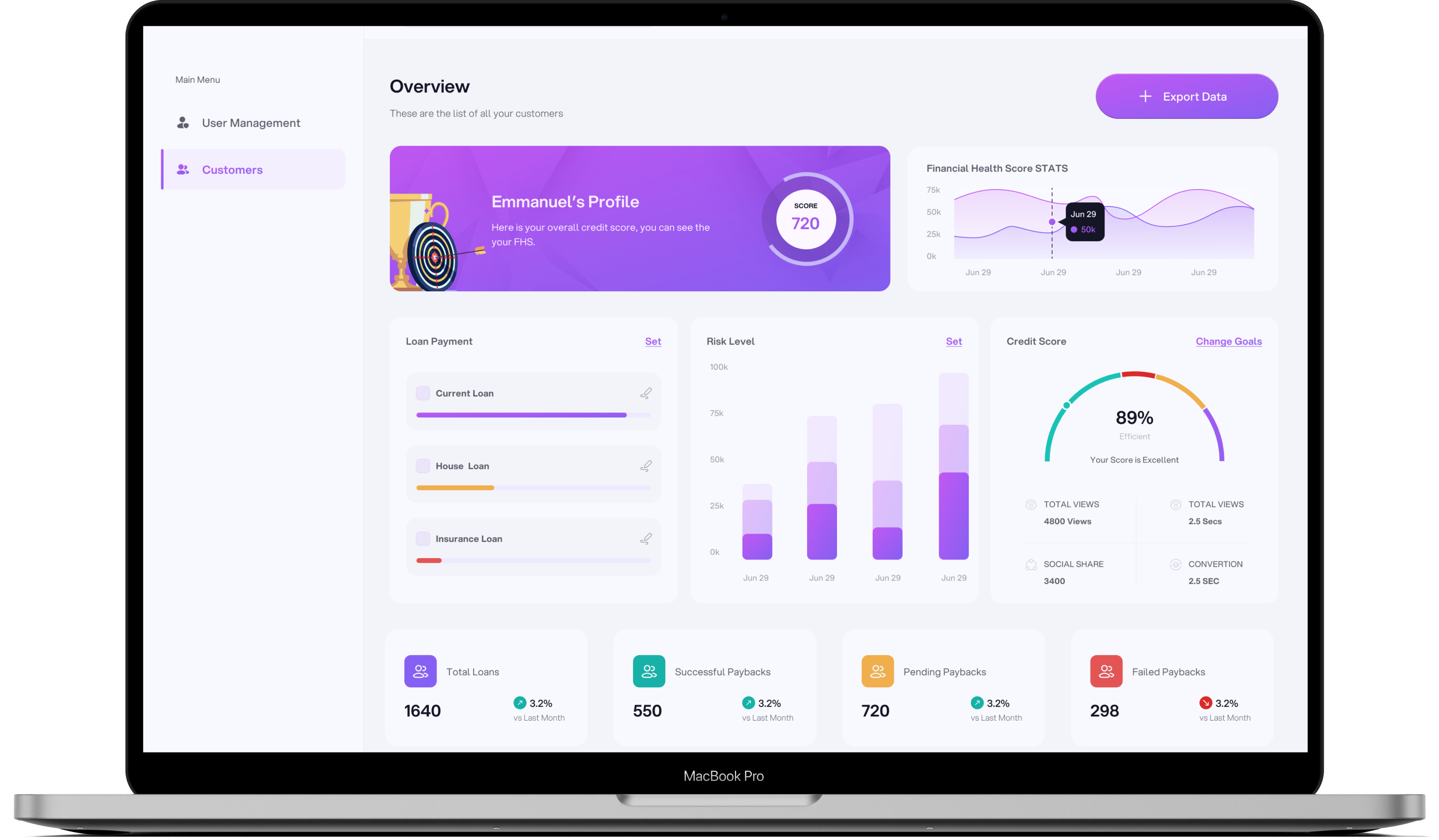

Aspayr for Businesses

Carefully designed to provide financial institutions with top-tier risk asssessment for making better decisions.

We are strongly driven by the realization of the SDGs by 2030.

In accordance with the 8th SDG (Decent Work and Economic Growth),

4 Billion i.e. 70% of the adult population is projected to become financially literate by 2030. The current figure stands at less than half of that.

Join Aspayr Waitlist

Be the first to know when Aspayr launches new updates from beta versions to new features!